capital gains tax rate increase

In an effort to tax wages and wealth at the same rate Biden wants to put the top income tax rate at the Obama-era 396 and also have the same 396 capital-gains rate apply to households making. Likelihood of capital gains tax increase in 2021.

This new tax could be especially impactful when considered alongside proposed federal capital gains tax rate increases.

. In Canada 50 of the value of any capital gains are taxable. Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals. House Democrats propose raising capital gains tax to 288 House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by.

Capital gains tax The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. In addition those capital gains may be subject to the.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. The rate jumps to 15 percent on capital gains if their income is 41676 to 459750. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75.

2022 standard deduction and personal exemption. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. Based on my income and the capital gains I profited from the sale I assumed I would pay a 15 capital gains tax.

The effective date for this increase would be September 13 2021. While it technically takes effect at the start of. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er.

I sold stock this past year and had capital gains of 183740. Long-term capital gains for such taxpayers would be taxed at the same rate as ordinary income. Capital gains tax will be raised to 288 percent according to House Democrats.

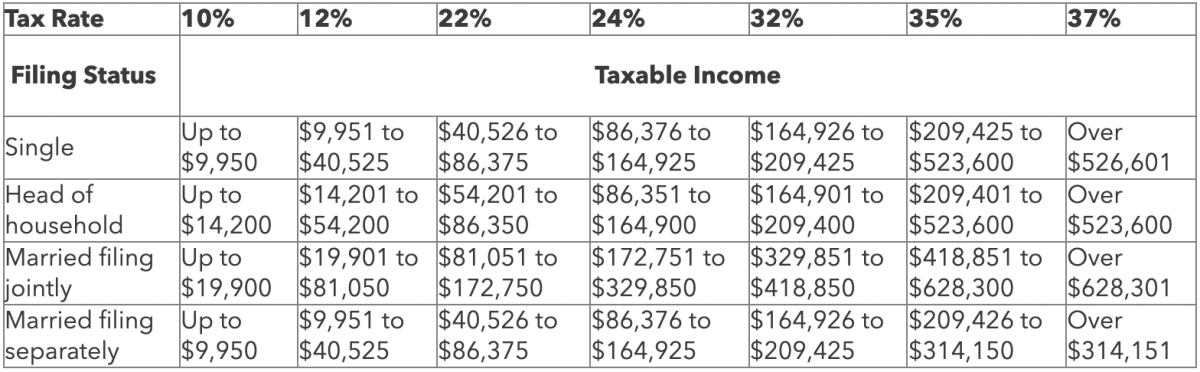

According to a. Capital gains tax would be increased to 288 percent. 10 12 22 24 32 35 and 37.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. A superior court judge recently determined the tax is unconstitutional. Capital Gains Tax Rate 2022.

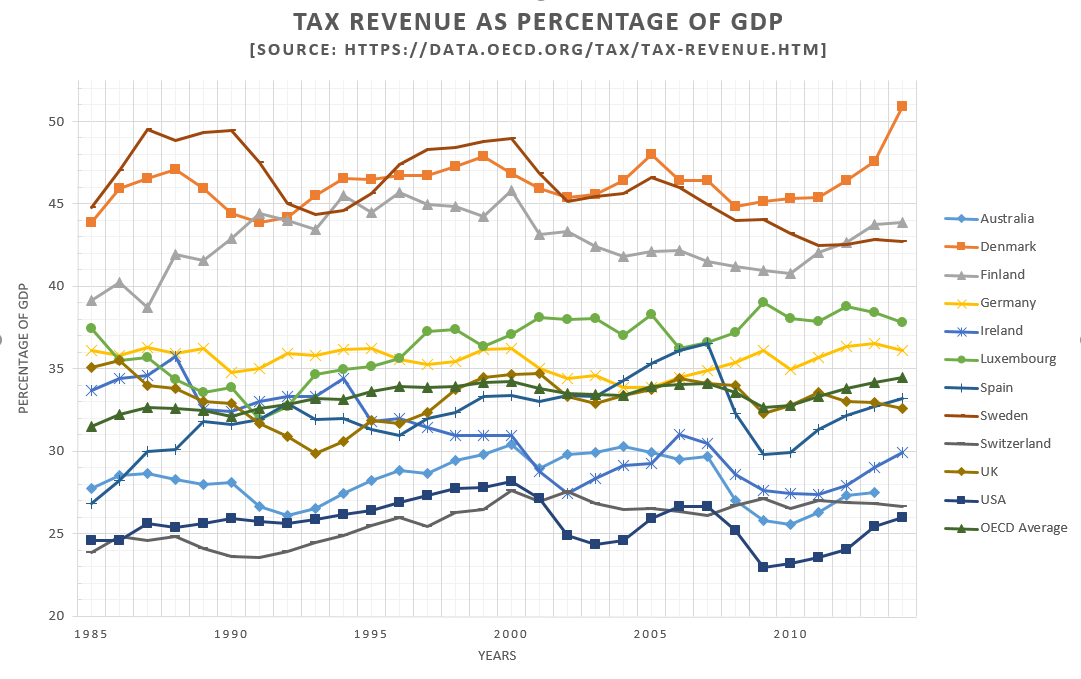

5 rows Capital gains tax would be increased to 288 percent according to House Democrats. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. Only Ireland has a higher rate.

2022 capital gains tax rate thresholds tax on net investment income theres an additional 38 surtax on net investment income nii that you might have to pay on top of the capital gains tax. The tax rate for these taxpayers would increase from 20 to 396 plus the 38 Affordable Care Act. President Joe Biden would raise the top tax rate on capital gains and dividends to almost 49 between federal and state taxes.

According to a house ways and means committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. In other words until you lock in the gain by selling the investment its only an increase on paper. The table also shows the inclusion Eligible.

When including the net investment income tax the top federal rate on capital gains would be 434 percent. The state of Washington enacted a capital gains tax on individuals who recognize gain from the sale of long-term capital assets. Capital Gains Tax Rate.

If you sell a property for more than you bought it for you will be taxed on 50 of the. The new rate would apply to gains realized after Sep. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as the.

Capital gains tax rates on most assets held for less than a. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. This sale was considered long-term and when I put the number into Turbo Tax the effective tax owed came out to 34544 which I calculated at 188.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The state intends to appeal. The good news is you only pay tax on realized capital gains.

Above that income level the rate climbs to 20 percent. Understanding Capital Gains and the Biden Tax Plan. 4 rows If you realize long-term capital gains from the sale of collectibles such as precious metals.

In 2022 it would kick in for single filers with taxable.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Definition 2021 Tax Rates And Examples

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Do Taxes Affect Income Inequality Tax Policy Center

The Capital Gains Tax And Inflation Econofact

How Do State And Local Individual Income Taxes Work Tax Policy Center

Taxing The Rich More Evidence From The 2013 Federal Tax Increase Equitable Growth

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)